[New Feature] Finance | Consolidate Invoices in Xero to improve Xero speed and payment reconciliation process

Release Date: 02 July 2020

Summary

As the Prism Finance module records all expense detail by horse, owner and date, and keeps that data as an historical account of charges, there is often little need to replicate the volume of data in Xero.

Furthermore, the default behaviour of our Prism to Xero integration is to create invoices in Xero unique to each owner and horse in a given Statement period. Customers typically will pay one amount per period to pay all horse invoices on their Statement. Accounts receivable administrators often need to select multiple invoices in Xero when reconciling owner payments.

To reduce the volume of data in Xero and to improve the reconciliation of customer payments to invoices, we have released a new feature where you can choose to consolidate invoices and/or invoice lines in Xero. In this article we explain the current Prism to Xero Invoice integration, and three new options you may elect to implement.

Current Prism to Xero Invoice creation

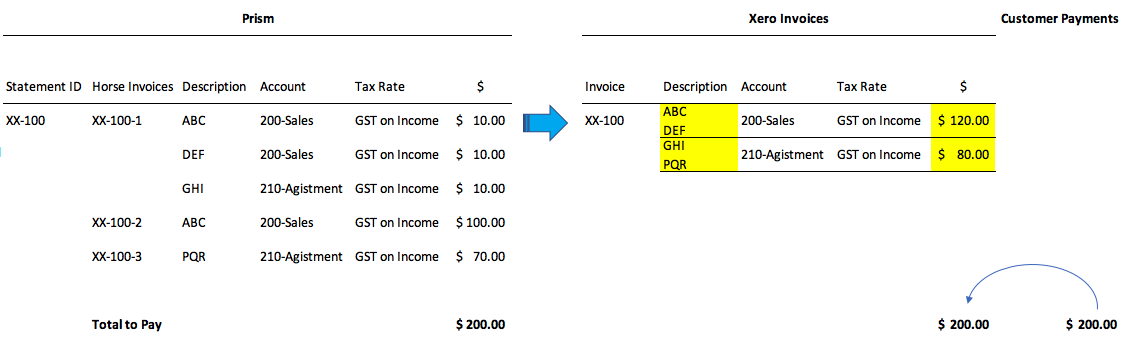

This example below shows how the integration creates invoices in Xero now.

Customers typically will pay one amount per period to pay all horse invoices on their Statement. Accounts receivable administrators often need to select multiple invoices in Xero (three in the abvoe example) when reconciling owner payments, adding time to the reconciliation task.

Option 2: Consolidate invoice lines by Account and Tax Rate

You can now choose to consolidate invoice lines in Xero by Account and Tax Rate, but retain unique customer invoices by horse.

Consider this example below.

Benefits > Reduce the volume of data in Xero. Improve Xero system performance.

To reconcile a customer payment with this option, you still need to select all relevant invoices (three in this example above).

Option 3: Consolidate invoices into one Xero invoice, and consolidate invoice lines by Description, Account & Tax Rate

To even further reduce data in Xero, you can now choose to consolidate invoices in Xero and consolidate invoice lines by Description, Account and Tax Rate.

Consider this example below. All invoices for an owner in a given Statement period are consolidated in one invoice in Xero, with the Xero Invoice Number matching the Prism Statement ID. But invoice lines (expense lines in Prism) are still itemised.

As the Xero Invoice Number matches the Prism Statement ID, the customer reconciliation process is greatly improved, provided your customers add the Statement ID as a payment reference.

Benefits > Reduce the volume of data in Xero. Improve Xero system performance. Reduce time required to reconcile customer payments.

Option 4: Consolidate invoices into one Xero invoice, and consolidate invoice lines by Account & Tax Rate

To minimise data in Xero, you can now choose to consolidate invoices in Xero and consolidate invoice lines by Account and Tax Rate.

Consider this example below. All invoices for an owner in a given Statement period are consolidated in one invoice in Xero, with the Xero Invoice Number matching the Prism Statement ID. But invoice lines (expense lines in Prism) are consolidated by Account and Tax Rate, and descriptions are merged to minimise data.

Benefits > Minimise the volume of data in Xero. Improve Xero system performance. Reduce time required to reconcile customer payments.

To take advantage of any invocie consolidation options above, please contact

support@prism.horse to request which option you desire. Please specify exactly the option you wish to implement, including the text description of the option.

Option 2: Consolidate invoice lines by Account and Tax Rate

Option 3: Consolidate invoices into one Xero invoice, and consolidate invoice lines by Description, Account & Tax Rate

Option 4: Consolidate invoices into one Xero invoice, and consolidate invoice lines by Account & Tax Rate

Related Articles

[Feature] Finance | Add Payment directly in Prism

Release Date: 22 October 2020 This release applies only to Prism Finance subscribers who do not use Xero or MYOB, integrated with Prism Finance. It enables owner payments to be recorded against the relevant owner account, directly within Prism. If ...[New Feature] Finance | Quick Share Sale Invoices

To benefit Trainers and Syndicators invoicing owners for share sales, we have implemented a "Quick Share Sale Invoices" feature, or "Quick Invoices" for short. Go to Finance > Add Invoice > Quick Invoice (instead of Single Invoice) The Add Quick ...Option to disable the synchronisation of $0 invoices to Xero

Release Date: 04 November 2021 On occasions, such as when a debtor is receiving a 100% discount, you may issue invoices for a zero amount. This is typically the case when a trainer owns a shareholding interest in a horse he/she trains. An overall ...[New Feature] Finance | Import invoices from a supplier who is using Prism

Release Date: 8 December 2020 Prism Finance subscribers can now import invoices received from any supplier who is also a Prism Finance subscriber. This new feature is ideal for trainers and syndicators who receive invoices from any other training, ...[Finance] Improvement to Payment Note template

1 June 2022 | Enhanced Feature| Finance | Payments In the template of the Payment Note that appears on end of month Statements, you can now: insert the unique secure Direct Debit Authorisation link to encourage owners to authorise you to direct debit ...